If you’ve experienced a water leak in your home, you may be wondering whether you can claim it on your insurance policy. The answer is not always straightforward, as it depends on a number of factors, including the cause of the leak, the type of home emergency cover and of insurance policy you have, and the extent of the damage.

Home insurance policies typically cover water damage caused by sudden and accidental events, such as burst pipes or overflowing washing machines. However, if the leak was caused by gradual wear and tear or neglect, your insurance may not cover the cost of repairs. It’s important to carefully review your house insurance policy to understand what is and isn’t covered, and to speak with your insurance provider if you have any questions or concerns.

Understanding Your Home Insurance Policy

When it comes to protecting your home, having a comprehensive home insurance policy can provide you with peace of mind. However, it’s important to understand the specifics of your policy to ensure that you have the coverage you need. Here’s what you need to know about your home insurance policy.

Policy Coverage and Exclusions

Your home insurance policy covers a range of risks and perils, but it’s important to be aware of the exclusions. Common exclusions include damage caused by wear and tear, damage from pests or vermin, and damage caused by acts of war or terrorism. It’s important to carefully review your policy documents to fully understand what is and isn’t covered by home insurance claims.

Claim Limits and Excess

Your home insurance policy will have a claim limit, which is the maximum amount that your insurer will pay out in the event of a claim. Additionally, you may have an excess, which is the amount you will need to pay towards the cost of the claim. It’s important to understand these limits and excesses to ensure that you have adequate coverage.

Types of Home Insurance

There are several types of home insurance policies available, including buildings insurance, contents insurance, landlord insurance, leasehold insurance, and freeholder insurance. Buildings insurance covers the structure of your home, while contents insurance covers your personal belongings. Landlord insurance is designed for those who rent out their property, while the insurers’ leasehold and freeholder insurance are specific to those who own leasehold or freehold properties.

In summary, understanding your home insurance policy is crucial to ensuring that you have the coverage you need in the event of a claim. Review your policy documents carefully and be aware of the coverage and exclusions, claim limits and excesses, and the type of home insurance policy you have.

The Claims Process for Water Damage

If you have experienced water damage in your home or business, you may be wondering how to initiate a claim with your insurance company. The claims process for water damage can be complex, but by following the steps outlined below, you can ensure that your water leak insurance claim, is handled efficiently and effectively.

Initiating a Claim

The first step in the claims process is to notify your insurance company of the damage as soon as possible. This can usually be done by phone or online. You will need to provide details about the escape of water damage, including the cause and extent of the water damage.

Role of Loss Adjuster and Loss Assessor

After you have initiated your claim, your insurance company will likely appoint a loss adjuster to investigate the damage. The loss adjuster will assess the extent of the damage and determine the cost of repairs. In some cases, your insurance company may also appoint a loss assessor to represent your interests during the claims process.

Documentation and Evidence Required

To support your claim, you will need to provide documentation and evidence of the damage. This may include photos of the damage, receipts for repairs, and any other relevant documents. Your insurance company may also require you contact your insurer to provide a detailed inventory of any damaged items.

Repair and Reinstatement Procedures

Once your claim has been approved, your insurance company will provide instructions on how to proceed with repairs and reinstatement. You will need to obtain quotes from contractors and submit them to your insurance company for approval. Your insurance company may also require you to use approved contractors.

In conclusion, the claims process for water damage can be complex, but by following the steps outlined above, you can ensure that your home insurance claim call is handled efficiently and effectively. By providing documentation and evidence of the damage and following the repair and reinstatement procedures, you can get your home or business back to its pre-damage condition as quickly as possible.

Preventing and Managing Water Leaks

Water leaks can cause significant damage to your property and lead to expensive repairs. While you may be able to claim a leak on your insurance, it’s always better to prevent leaks from happening in the first place. Here are some tips to help you prevent and manage water leaks in your home.

Regular Maintenance and Upkeep

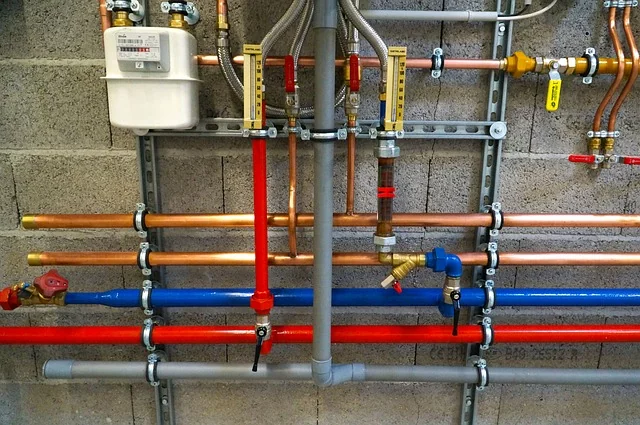

One of the best ways to prevent water leaks is by conducting regular maintenance and upkeep. This includes checking your pipes for wear and tear, making sure your stopcock is working correctly, and keeping an eye out on frozen pipes for any signs of leaks. You should also consider having a professional plumber conduct an annual inspection of your plumbing system.

Immediate Steps to Control a Leak

If you do experience a leak, it’s essential to take immediate steps to control it. The first thing you should do is turn off your internal stopcock to stop the flow of water. You should also try to contain the leak by placing a bucket or towel underneath it. If the leak is severe, you may need to turn off your mains water supply and call a professional plumber for assistance.

Professional Leak Detection and Repair

If you suspect you have a water leak but can’t locate it, it’s essential to call in a professional leak detection service. These professionals use advanced technology to locate leaks, even those hidden behind walls or under floors. Once the leak has been detected, a professional plumber can repair it quickly and efficiently, helping to drain the system and prevent further damage to your property.

In conclusion, preventing and managing water leaks is crucial to avoid expensive repairs and potential insurance claims. By conducting regular maintenance and upkeep, taking immediate steps to control leaks, and calling in professional help when needed, you can keep your plumbing and heating system both in good condition and avoid the hassle of dealing with water damage.

Special Considerations for Insurance Claims

When making an insurance claim for a leak, there are several special considerations that you should keep in mind. In this section, we will cover some of the most important factors that you should be aware of when making a claim for water leak insurance.

Trace and Access Coverage

Trace and access coverage is an optional add-on to your home insurance policy that can be very useful when making a claim for a leak. This type of coverage will typically pay for the cost of locating the source of the leak, including the cost of any necessary investigation such as moisture surveys or thermal imaging.

Accidental Damage and Natural Disasters

When making a claim for a leak, it is important to understand whether your policy covers accidental damage or natural disasters. If the leak was caused by a sudden and accidental event, such as a burst pipe, then it may be covered under your accidental damage coverage. However, if the leak was caused by a natural disaster, such as a storm, then it may be covered under your accidental damage cover or your natural disaster coverage.

Impact on No-Claims Bonus and Premiums

Making a claim for a leak can have an impact on your no-claims bonus and your premiums. If you make a claim, then you may lose your no-claims bonus, which can result in higher premiums in the future. However, if the leak is severe and you need to make a claim, then it may be worth it to pay the higher premiums in order to get the coverage you need.

Overall, it is important to carefully review your insurance policy and understand what is covered before making a claim for a leak. If you are unsure about anything, then it is always a good idea to consult with a chartered surveyor or other insurance expert to get a better understanding of your coverage and options.